In a recent survey of over 30 retailers, McKinsey found that merchants spent “approximately than two-thirds of their time gathering data, managing exceptions, “firefighting”, and participating in meetings to syndicate with colleagues, and only one-third of their time working on critical strategy and analytics or insights.”

We have discussed in our previous blogs how the retail landscape is undergoing a complete transformation: with the rise of e-commerce and in the use of technology, more demanding consumers than ever before, and cut-throat competition from across channels, retailers have to be on their toes at all times to survive. While enhancing existing processes, like adding manpower, monitoring competition more closely, or making aggressive moves in the market might help, such improvements are likely to be marginal. This is true especially for fashion retailers, given the fast-paced nature of the fashion industry. Today, both the product and trend life-cycles are shortening, and they are likely to continue in this direction. What can fashion retailers do to keep up?

The core function of any fashion retailer is its merchandise planning. In these times of uncertainty, these organizations must focus on improving the capabilities of this core function. With shortening product and trend life-cycles, the fashion retail business has become ‘winner-takes-all’, where the size or heritage of a company has little-to-no bearing on a customer’s decision to buy something. This change in consumer sentiment has found the big retailers wanting a way out, while the smaller, more nimble organizations have been able to adapt relatively easily. In today’s business environment, speed is of the essence. We briefly touched upon this in our previous blog.

Merchandise planning, however, is a large container of many sub-processes. To be able to improve merchandise planning, a retailer must narrow its focus down to the sub-processes, and work on improving them. Improvements in these sub-processes will lead to an overall enhancement of merchandise planning. One such sub-process, and arguably the most important of the lot, in Option Planning (OP).

Option Planning, or Assortment Planning, is the process by which a retailer selects which products and how many of each product it will release in the market to maximize its profits. Traditionally, assortment planning has been product-based. Today, it is becoming increasingly consumer-based. In its survey, McKinsey found that the differentiating factor between the top and bottom performers was that the top performers routinely used consumer insights very early in the product design process. More on this soon.

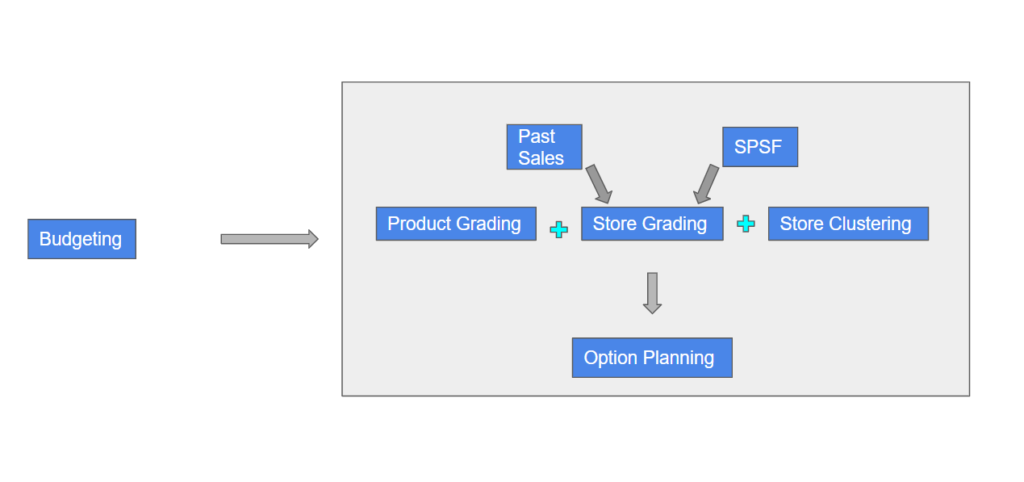

There is a preliminary step to OP, a precursor to the planning process: the budget. Budgeting plays a very crucial role in determining what the OP will look like, in that budgeting gives it scope. This process involves taking the crucial decision of how much revenue needs to be generated by the outlets of the fashion retailer in the forthcoming season.

The Option Planning process starts once the budget has been set. The goal of this process is to answer the following questions:

● How many options need to be offered to achieve the target?

● What are the price points at which these options will be offered?

● How many options from the previous season, if any, will be continued this season?

In short, the company decides what its Assortment Mix will be, including the depth and width of its offering, keeping in mind its brand value. It is very important to strike the right balance here.

Getting the OP right is important for the company to generate profits. It is the largest factor in determining a fashion retailer’s profits. A right OP ensures that the right product is available in the right place, at the right price. The combination of these 3 Ps of marketing will help in maximizing sales, bringing in profits for the company. This will also help achieve greater customer satisfaction, lowered discounts, lesser inventory and markdowns, and lesser stock in hand that needs to be liquidated through discounts. Moreover, it will avoid embarrassing out-of-stock situations, which have been known to cost a lot: according to the retail analyst IHL, retailers worldwide lost around $1 trillion in 2018 due to out-of-stock situations. In addition to that, in the fashion business, innovation in products is an important key to a company’s success, thereby underscoring the importance of getting the OP right even further.

As we mentioned earlier, traditionally, the OP process has been product-based, and that is now changing fast to become more consumer-based. What does this mean?

Conventionally, OP comprised of one step: Product Grading. This, too, was specific to those companies that planned to continue an option over more than a single season. The grading process was carried out to determine which options will be worth continuing for another season, and which will not. This was a fairy discretionary process, as the decision was made based on thresholds that the retailer decided itself. Fresh styles also needed to be introduced, so this product grading process helped determine how many new styles were needed to achieve the target set by the budget. This is why the traditional OP process is said to be product-based: the process does not consider the preference of the consumer in any way/

These days, another step has been added to the OP process: Store Grading. This step is at least as important, if not more, than that of Product Grading. As the name suggests, Store Grading distinguishes one store from another to make it easier for planners to make crucial decisions in the OP process. For this, it uses two metrics: sales per sq. ft. (SPSF) and total sales performance (historically) of the respective stores. While using the former metric is widely recommended, the industry tends to focus more on the latter. The basic intent behind Store Grading is to capitalize on the opportunities for sales and profit from top-performing stores and take lessons from them to push the stores with lower performance levels upwards as well. Store Grading is very helpful for companies with too many SKUs to keep track of – in this way, it helps in simplifying Product Grading as well. Distributing focus among the SKUs based on whether they feature in the top or bottom-performing stores optimizes the planner’s time as well.

Store Grading is also of varying degrees. While the small and medium-sized fashion retailers, with a smaller number of stores, can benefit from a single Store Grading process, larger retailers with a greater number of stores can’t. Therefore, larger retailers also conduct Store Grading based on regions. This means that a store that might have otherwise been given an A grade nationally, may end up getting a B grade regionally. This is extremely useful in the planning process because it averts suboptimal use of resources in a major way.

Large retailers also conduct Store Clustering, which uses statistical techniques to group stores based on consumer behaviour at the respective stores. In today’s market, where the customer demands personalization, clustering is essential for any retailer serving diverse geographies like India’s. There are several approaches to clustering, i.e. the criteria based on which the clusters are formed. Some examples are clustering by store attributes, clustering by sales performance of categories, and clustering by price. The common benefit from clustering, however, is a more efficient use of resources.

With the addition of Store Grading and Store Clustering, the focus of the OP process shifts from being product-based to being more consumer-based, since store data is a direct reflection of the consumer sentiments. It also becomes less discretionary because the decisions are now made not solely on metrics based on the retailer’s discretion, but also on the actual sales data, therefore involving the customer’s point of view as well.

So, what’s next for retailers? What is the most convenient way to make this move to embrace this new trend?

Board’s Retail Planning platform is the answer. Here is how Board can make this transition seamless for any retailer:

● It enables planners to compare their proposed assortment mix for any store with the store’s capacity and see if the mix is the right fit, vis-à-vis the target as well.

● Its dashboard feature gives planners the big picture at all times: at any point in the planning process, what is the space left, how far is the target, how much freshness can be added to the mix.

● Easy grading based on previous years’ data and also on SPSF

● Whether the plans are for clusters of stores or individual stores, Board has the can go to intricate levels.

● Instant and accurate reports for any stores, or group of stores.

In summary, Board’s Retail Planning platform helps save precious time for planners in fashion retail companies. They can now put this time to better use, in taking decisions on strategy and creative, armed with data from Board. This is the winner’s strategy, too: in the same report, McKinsey says that the top performers in the fashion retail use data analytics while developing concepts and planning lines – the heart of the creative process. Underperforming companies, on the other hand, tap the data only much later in the process, after having developed the product.

Reach out to us today to speak to a Board expert, and see how it can work for you!